CIT Academy 2022The CIT Academy project is designed to promote cutting-edge research, facilitate knowledge exchange, foster innovation development, and drive technology application within the Thai insurance industry.

In addition, the project aims to establish a robust network for the CIT, encompassing university students, the general public, insurance industry professionals, tech firms, and various startups. |

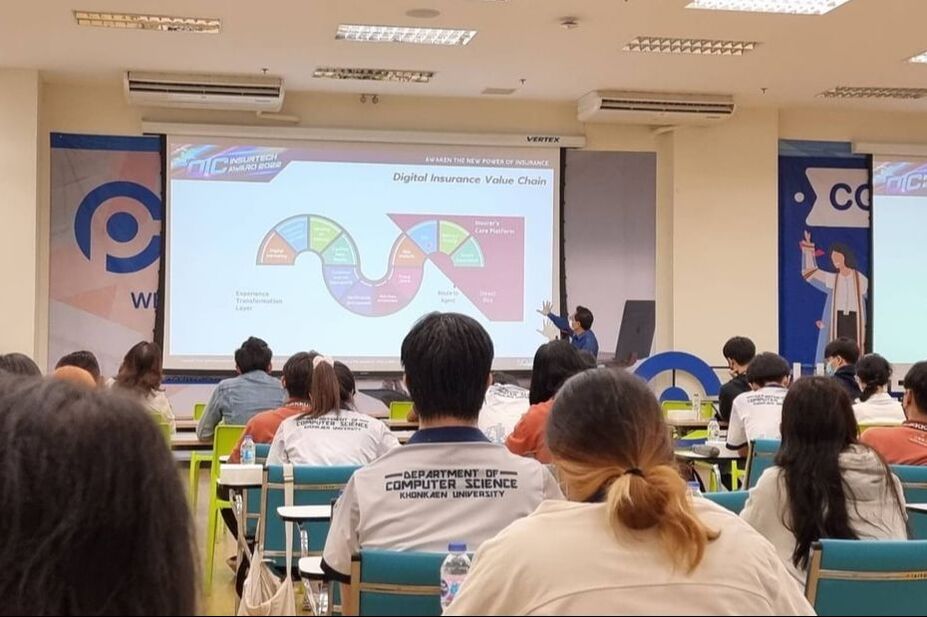

CIT InsurTech Roadshow

|

|

|

The CIT InsurTech Roadshow is an activity that aims to support knowledge sharing and technology utilization within the insurance value chain. The target audience of this activity includes students, professionals in the insurance industry, individuals working in tech firms and startups, and the general public interested in insurance technology. Additionally, the event encompasses proactive promotional activities to introduce the CIT (Center of InsurTech, Thailand) and invites the target audience to participate in the OIC InsurTech Award. |

InsurTech Bootcamp

|

|

|

The InsurTech Bootcamp is an activities-based learning workshop designed for the selected applicants of the OIC InsurTech Award. Its purpose is to deepen participants' understanding of technological integration within the insurance sector. Additionally, this bootcamp offers online courses and intensive coaching activities led by expert speakers, providing valuable insights to enhance participants' projects. This workshop not only cultivates participants' innovation skills but also serves as a platform for expanding their knowledge in InsurTech and encouraging them to exchange ideas to spark innovations within the insurance landscape. After participating in this bootcamp, the committee will select the teams that deliver impactful projects potentially applicable to the insurance industry to compete in the final round of the OIC InsurTech Award. |

OIC InsurTech Award 2023

|

|

|

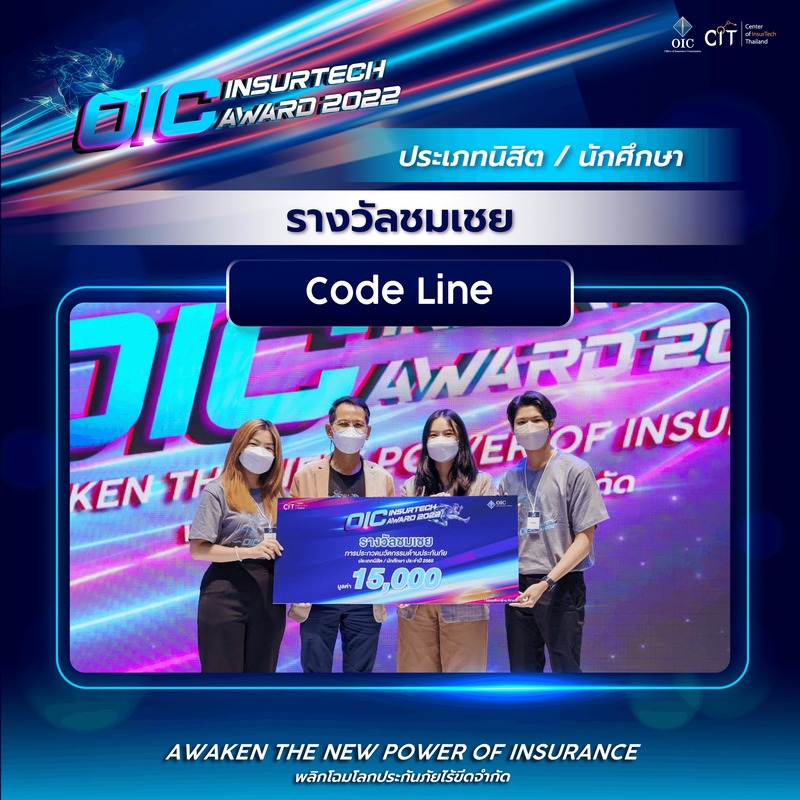

The OIC InsurTech Award 2022 were held under the theme "AWAKEN THE NEW POWER OF INSURANCE." This competition featured three main topics:

1. Technological innovations for healthcare insurance tailored for modern society. 2. Transforming the sales approach and exploring new insurance opportunities in the Metaverse. 3. Enhancing risk assessment efficiency and elevating customer satisfaction with AI technology. The competition was divided into two categories: the student category and the general public category. Applicants had to pass the selection process by a qualified committee from various industries, resulting in only one winning team in each category. |

General PublicThis team proposes a platform connected with medical clinics, providing a cost-control system for treatment expenses, prescription dosages, and medical treatment fees. The platform also includes a fraud detection system, enabling insurance companies to offer health insurance products that allow the insured to pay less for their premiums and get medical treatment at clinics easily. This platform suits low-income customers or those wanting to increase their insurance coverage.

The Blue Oak team introduces a device for detecting elders' stumbles and accidents through sound waves. The device will promptly signal for help from rescuers or hospitals, facilitating faster response times, reducing losses, and minimizing compensation costs.

The Meddit team introduces a ready-to-use OCR-powered application capable of scanning insurance policy documents, extracting essential information, and summarizing details in various aspects. The application aims to recommend insurance coverage that customers may not currently have and reduce the time for insurance advisors to analyze each insurance policy from 4 to 20 hours to just 20 minutes.

The Coves Paratex team proposes a platform for providing parametric insurance services by using Smart Contracts to automatically compensate for damages incurred in case of delays in cargo transportation (Cargo Insurance). This platform also integrates Blockchain and AI to enhance its efficiency.

Buddy Survey provides a platform that gathers various surveyor companies and enables insurers to connect with the surveyor closest to the accident scenes. The platform utilizes AI technology to assist in finding the most suitable surveyors nearby for each job. It also offers the TeleClaim service to customers, allowing them to claim their compensation by themselves.

|

StudentsThe Schmettering team acknowledges the rising number of individuals dealing with mental health issues and their concerns about in-person consultations with psychiatrists. Therefore, they suggest an AI-powered application designed for psychiatric patients, offering online consultations, diagnosis, health assessments, and reasonable insurance premiums.

The Plantpot team proposes an application supporting risk management and health services for insurance policyholders in the long run. This application aims to help insurance companies track the health data of policyholders, allowing the company to tailor insurance premiums for individual customers. The application utilizes Big Data technology to gather and process health information. It also uses AI technology to accurately assess the risk of each policyholder and determine appropriate insurance premiums for them.

The Metta team presents the idea of creating a community on the Metaverse specifically designed for seniors with health insurance. This community would include exercise rooms and healthy restaurants where users can order virtual foods in the Metaverse and have them delivered to the real world. This Metaverse community will also have physicians monitoring elders' health conditions, psychologists providing consultations, and insurance service desks for their inquiries regarding insurance products.

The Code Line team proposes an AI-integrated application for insurance surveyors to enhance their speed and precision in evaluating risks. This application also utilizes technologies such as Machine Learning, Voice Analytics, and 3D Scanning from videos and images to collect data from accident scenes, record incident details, and assess damages.

The Infinity team proposes an application allowing customers to initiate self-claims. By scanning the accident scene, this VR-integrated application can virtually simulate and assess accidents and damages without requiring any surveyors to inspect the scene. Moreover, insurance representatives of all parties involved in the accident can connect, negotiate compensation expenses, and promptly update their customers via SMS once the damage assessment is completed.

|