Thailand InsurTech Fair 2021, organized by the Office of the Insurance Commission (OIC) in collaboration with the Center of InsurTech Thailand (CIT), is the biggest insurance fair of the year. With the theme, "InsurTech for all and for the next normal," this event showcases a diverse range of insurance products from leading companies. It brings together insurance experts and industry insiders from around the globe to build networks, share experiences, and exchange new knowledge related to insurance.

Activities

Success Story

|

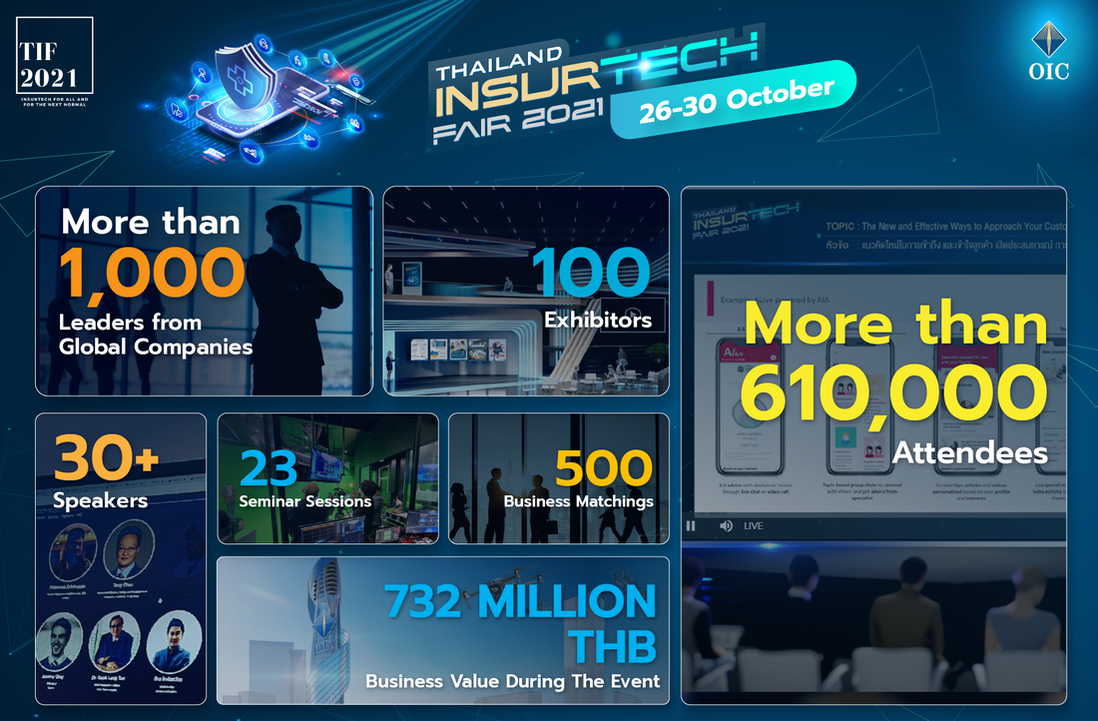

For the response of the event "Thailand InsurTech Fair 2021" is considered a great success. In terms of changing the format of the event and the number of visitors from all over the world (both domestically and internationally). The event is organized from 26 to 30 October 2021 as total of 5 days. There were more than 100,00 people to participate in activities in various zones, and there were more than 710,000 clicks. In the part of insurance purchasing at the event, insurance policies are sold with premiums up to 732 million baht, totaling more than 15,000 policies, life insurance products, insurance premiums 652 million baht. 6,834 policies, non-life insurance products, with insurance premiums of 80 million baht, 8,412 policies.

|

Seminar

|

|

|

|

|

Learn the global trends. From major FinTech and InsurTech trends such as AI, Cryptocurrency, and DEFI to Regulatory Perspectives and Insurance Market Developments.

How regulations help to strengthen the financial and insurance landscapes through the adoption of technologies e.g. the use of SupTech or Regulatory Sandbox. What are the global regulators' strategies for improving their Country's Digital Infrastructure? And how do the Insurance/InsurTech industry benefit from them? |

|

|

In the era of the pandemic like Covid-19, which makes customer meetings and services much harder or impossible. To get through this crisis, many corporations were adjust their strategies such as faster technology adoption, a new way of sales team management, better techniques for team morale management, and lots more. But this crisis also has created additional opportunities for the corporation to move quickly to achieve success, sustainably.

|

|

|

|

|

|

How interesting would it be if your organization had colleagues who were innovators like Elon Mark?

Because if only executive teams are aware of the importance and enormous benefits of the innovation is not enough to make the organization become an organization that uses innovation as an important weapon in building its strength. What must we do? How to make our organization ready to accept a culture of creating and developing innovations, creating benefits for the organization effectively and sustainably at the same time? |

|

|

The world currently faces such a time of uncertainty, with digital disruption, global warming, and the pandemic. What does this mean for the insurance industry and how can it remain on its footing despite the unpredictable era?

With the introduction of InsurTech, insurance companies are sustained to securely operate long-term as technology innovations are designed to increase efficiency of the current insurance model. This session will identify trends and innovations in InsurTech which could be leveraged on to benefit the Thai insurance industry, and help navigate your businesses in this time of uncertainty. |

|

|

How is HealthTech going to play an important role in enhancing the insurance business opportunities?

Let's open up and talk about HealthTech trends that will create new opportunities for the insurance industry. Study new ideas from the successful entrepreneurs that can be applied to insurance businesses and learn about what HealthTech expects from the insurance industry. In particular, how insurance technology or InsurTech will help develop the integration of HealthTech and Insurance Business together to enhance the benefits of each other. Thus, deliver additional benefits for customers and the general public. |

|

reative Approach: What Do Customers

With the changes in society and advancements in the technological world, insurance businesses need to upskill to better recognise the consumer behaviours and perspective of its customers. Understanding the experience of purchasing insurance is imperative for the improvement of insurers to better satisfy their clients. Finding creative approaches such as looking into social media marketing and utilising existing online platforms will enable agents and brokers to expand their opportunities in promoting their products.

In this segment, we will learn the market trends, the customer's journey and expectations in purchasing insurance, to discover how businesses can better boost sales and cater to their consumers. |

|

|

|

How InsurTech can become opportunity-enablers and connected to all other Techs

Learn the real cases study that explains why InsurTech is a key component for opens up and helps connect with all the other Techs, and how big is the benefit of doing that? How great would it be if the development and application of InsurTech were not just for the insurance industry? Because many businesses see insurance as a tool to increase their business opportunities, using InsurTech as an enabler linkage to All Technologies. |

Digital ID:

Let's learn together How to use digital ID for insurance businesses by taking full advantage of blockchain technology. In both Practical Uses and Real Case Examples. Share all knowledge to help enhance the security for both customers and the organization. Through knowledge sharing from decades of experience from the enterprise’s security expert.

|

IT Architect Best Practice:

In an ever-changing world where the news each day differs and advancements are always made, businesses need to constantly adapt to the shifting trends. To meet the demands of the customers and enhance the quality of the insurance industry, a flexible system that is able to support the rapidly evolving future is vital. Though the consumers’ demands may vary, businesses should always be responsive to the needs of its customers.

Thus, through experts’ sharing of their experiences, today’s session will reveal a suitable system that can be developed for insurers to utilize IT and project planning. This would lead companies to better internal management which can fulfill customers’ demands. |

Mastering the Uncertainty:

The Insurance industry is changing by disruptive forces and the COVID-19 pandemic pushed insurers to race in digital transformation. Although the crisis has presented tremendous challenges and uncertainty, the industry can rise and embrace the necessary changes and opportunities in the new reality. In this session, the speaker would like to propose a 3 R framework (Re-imagine, Re-plan, Re-create) that sets out how insurers can envision transformation and what it will take to achieve in the post-COVID world.

|

Turn IT Investment

Information technology (IT) is an essential tool for various fields of industries. This includes the insurance sector as businesses need to adopt IT systems into their operations. Though it may be viewed as a seasoned player in the technological industry which grants convenience and reduces the workload of people’s work. Many don’t realise how profitable the infrastructure can be for businesses when it is appropriately planned and assigned to work.

Hence, this session will reveal to insurers, both experienced or new to the industry, the applicable ways and mindset to invest well with IT, so as to boost more profits in the long run. |

Deep Tech and How It Matters

Even before COVID, many people recognize that Insurance is an industry that is ripe for transformation. Post-COVID, we can see the pace of transformation accelerating. In this talk, you will learn how Artificial Intelligence (AI) , a type of Deep Tech, has the power to transform many parts of the insurance value chain, from Claims Automation, to Fraud Detection and Agent Management with real world Case Studies from this region. You will also learn how to avoid some pitfalls if AI is not deployed properly.

|

Risk in Perspective: Manage It All

In an ever-changing world full of uncertainties, the insurance industry faces various challenges. The Covid-19 pandemic has affected asset risks, volatility in capital markets, and growth prospects of the global insurance industries. As the impact of climate change becomes more prominent, regulators may consider using insurers to counter it. In addition, the increasing number of businesses is bringing about demand for new and different insurance service solutions.

In this panel discussion top global risk management experts will give their insights and share their experience on the future direction of risk management within the insurance sector in Thailand and Southeast Asia. |

Digital Revolution for the Benefit

In many ways, the Asia-Pacific region holds the key to the insurance industry’s future. It is home to nearly one-third of the world’s population, a few of the fastest-growing economies and multiple countries with rapidly expanding middle-class populations. With the current pandemic and rise of intra-ASEAN trade and investment, it grants an opportunity for the InsurTech industry in the ASEAN region. There is a need for the use of technology innovations to squeeze out savings and efficiency from current insurance models, leading to the rise of InsurTechs. In this session, we will also be exploring one of the latest trends in the insurance industry - the building of insurance ecosystems. Insurance ecosystems allow insurers to reach untapped markets and with a more comprehensive offering, it can reach customers more easily. We will also unravel the potential that InsurTech has in ASEAN, and the digital regulations which will benefit its industry.

|

New Evolution

Get ready for any upcoming customer’s needs.

Prepare yourself for the demands of your clients in the future with ever-changing needs to become a successful broker/agent and increase your future growth opportunities. Therefore, it is necessary to know how to take full advantage of those evolutions. To create timely customer care experiences with lower costs and provide services that meet the highest customer demands that shift constantly. |

The Rise of Robot in Insurance RPA

Living in a rapidly evolving digitalized world, the quality and efficiency of work cannot be shortchanged. Robotic Process Automation or RPA is software that is designed to reduce the burden of employees from completing repetitive and simple tasks. With the possibility of changes in industries that may affect the workforce, RPA benefits insurers in designing a high-growth business strategy while reducing cost.

Today’s Panel Discussion will unfold what RPA truly is and its importance to the insurance industry, as we learn from successful case studies of businesses who have implemented RPA into the organization workflow. |

InsurTech 2.0, the Next Evolution

The insurtech landscape is evolving rapidly, especially in Asia. Insurers are gaining a better understanding of what insurtech is and the value it can bring. They’re seeing it less as a disruptor and more as an opportunity to tap into the great ideas in the insurance ecosystem and to find meaningful opportunities to partner and collaborate. Insurtech phase 2.0 will see more insurers leverage insurtechs to continue to digitally transform their customer experience.

|

Exhibitors

The Thailand InsurTech Fair 2021 took place online, featuring virtual booths showcasing insurers' products through posters and videos. This exhibition also allowed customers to make an online payment and inquire about products directly through messages and calls with representatives from insurers. Additionally, insurance companies could provide agents to support customers in this event.