Thailand InsurTech Fair 2021 (TIF)

The best annual event that is full of the insurance products from all leading Thai Insurance companies. Insurance technology specialists or InsurTech from around the world are here for you to learn and get the chance to access the goods and services in various forms of insurance. Also, you can share experience, expand the network, and create new innovations with the private sector, related governmental association, agencies, and leading companies in the industry both domestically and internationally, Come and Join us.

|

|

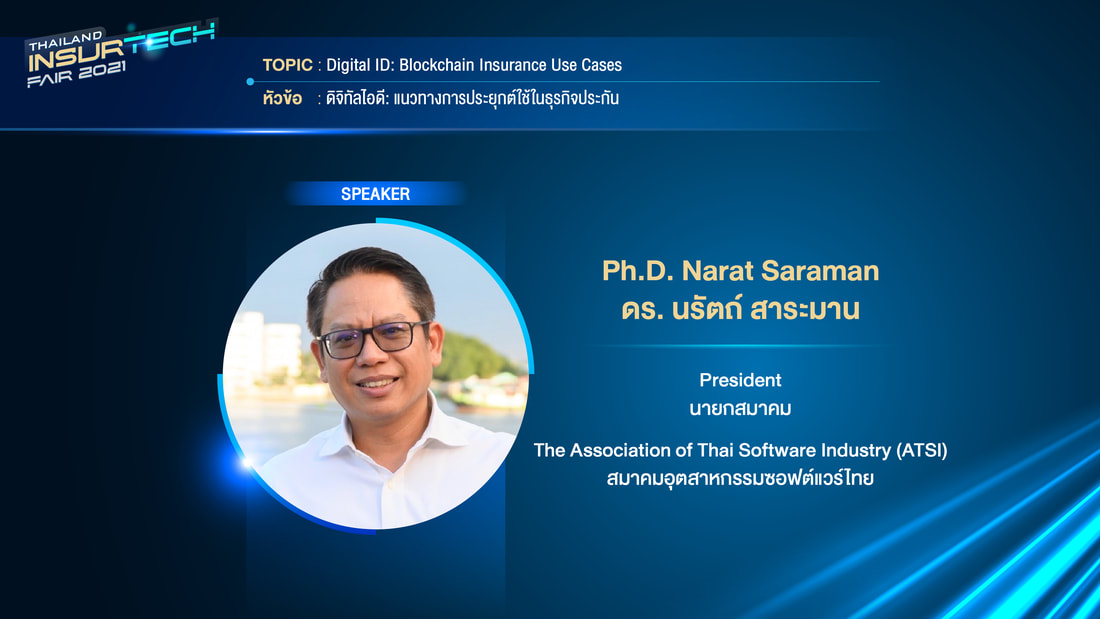

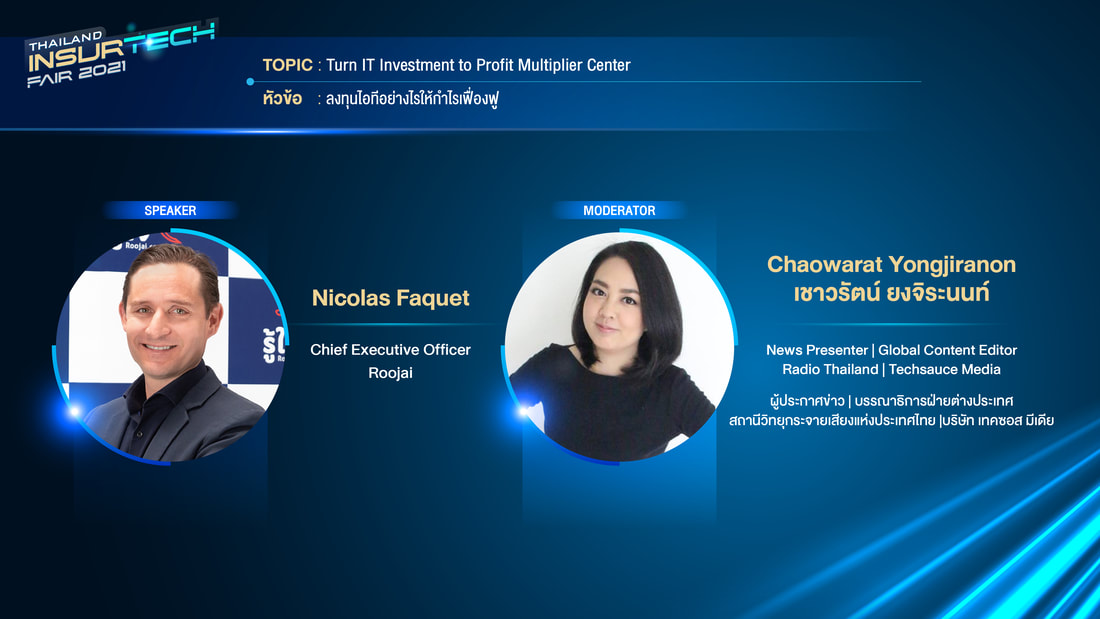

Inspiring seminar forum from highly talented speakers who will come to talk and to share tips and techniques from real experience in insurance industry. In terms of insurance rules in the digital age, the adaptation of insurance industry within the New & Next Normal era, the industry's adjustment, insurance technology and tips and tricks. There are also giveaways during the seminar event. *Every seminar topic will be translated into 2 languages, Thai-English. For brokers and agents, you may not have known about how to adapt yourself better to your organization before, so ;et choose to listen according to your aptitude! Or watch the seminar video later when you have the available time.

|

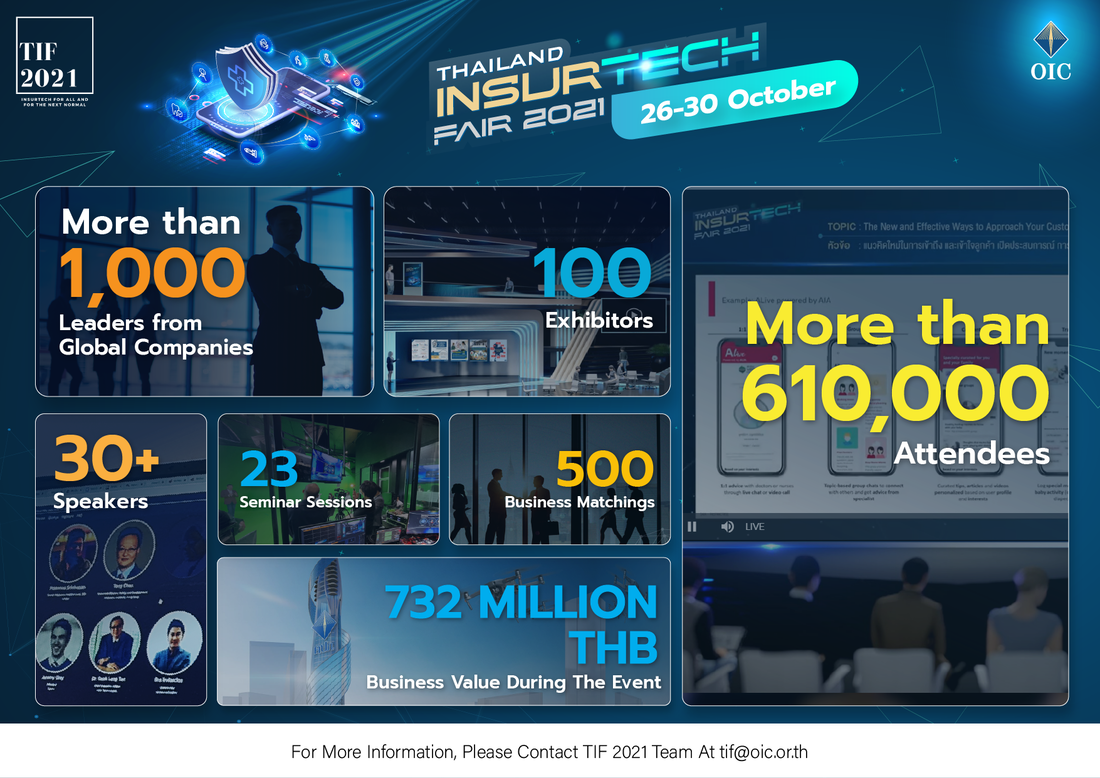

For the response of the event "Thailand InsurTech Fair 2021" is considered a great success. In terms of changing the format of the event and the number of visitors from all over the world (both domestically and internationally). The event is organized from 26 to 30 October 2021 as total of 5 days. There were more than 100,00 people to participate in activities in various zones, and there were more than 710,000 clicks. In the part of insurance purchasing at the event, insurance policies are sold with premiums up to 732 million baht, totaling more than 15,000 policies, life insurance products, insurance premiums 652 million baht. 6,834 policies, non-life insurance products, with insurance premiums of 80 million baht, 8,412 policies. |

Seminar

|

Dr. Suthiphon Thaveechaiyagarn

Secretary-General, Office of Insurance Commission (OIC) |

Future Regulations Landscape:

Every regulator has an important role and function. The Office of Insurance Commission (OIC) of Thailand plays important role in modernizing the insurance industry for sustainability. The OIC is not only open-minded, flexible, and modern compared to other regulators, but we also developed and adapted ourselves to become modern regulator.

Using principal-based regulations and all the tools we have to regulate and promote the insurance industry together with driving the use of InsurTech to enhance the efficiency in doing businesses and provide the next level of policy holders’ services. |

Global Trends: Perspective

Learn the global trends. From major FinTech and InsurTech trends such as AI, Cryptocurrency, and DEFI to Regulatory Perspectives and Insurance Market Developments.

How regulations help to strengthen the financial and insurance landscapes through the adoption of technologies e.g. the use of SupTech or Regulatory Sandbox. What are the global regulators' strategies for improving their Country's Digital Infrastructure? And how do the Insurance/InsurTech industry benefit from them? |

|

|

The Great Rebuild In the era of the pandemic like Covid-19, which makes customer meetings and services much harder or impossible. To get through this crisis, many corporations were adjust their strategies such as faster technology adoption, a new way of sales team management, better techniques for team morale management, and lots more. But this crisis also has created additional opportunities for the corporation to move quickly to achieve success, sustainably.

|

|

Young YangGeneral Manager, Southeast Asia,ZA Tech Global

Nadia SuttikulpanichHead of Fuchsia Innovation Centre, Muang Thai Life Assurance

|

To adapt and change in order to become a Digital Insurer, in addition to having the right Technologies & Partners, there are two important things to prepare. First is the capability of the organization, second is the mindset or the way of thinking of various personnel whether at the executive level or at the operational level.

If one could not have them right, investing to become a Digital Insurer will not succeed as quickly as one think. And most importantly, it may cause a lot of friction in both internal and external work. And that will surely effect customer services as well.

If one could not have them right, investing to become a Digital Insurer will not succeed as quickly as one think. And most importantly, it may cause a lot of friction in both internal and external work. And that will surely effect customer services as well.

Theresa BlissingFounder and Director, Asia InsurTech Podcast

How interesting would it be if your organization had colleagues who were innovators like Elon Mark?

Because if only executive teams are aware of the importance and enormous benefits of the innovation is not enough to make the organization become an organization that uses innovation as an important weapon in building its strength. What must we do? How to make our organization ready to accept a culture of creating and developing innovations, creating benefits for the organization effectively and sustainably at the same time? |

Building a culture that embraces

|

InsurTech Revolution:

|

Elton QiuHead of Product, Insurance, OneConnect Financial Technology, an associate of Ping An Group

|

The world currently faces such a time of uncertainty, with digital disruption, global warming, and the pandemic. What does this mean for the insurance industry and how can it remain on its footing despite the unpredictable era?

With the introduction of InsurTech, insurance companies are sustained to securely operate long-term as technology innovations are designed to increase efficiency of the current insurance model. This session will identify trends and innovations in InsurTech which could be leveraged on to benefit the Thai insurance industry, and help navigate your businesses in this time of uncertainty.

With the introduction of InsurTech, insurance companies are sustained to securely operate long-term as technology innovations are designed to increase efficiency of the current insurance model. This session will identify trends and innovations in InsurTech which could be leveraged on to benefit the Thai insurance industry, and help navigate your businesses in this time of uncertainty.

Prof.Dr. Chalerm HarnphanichM.D.,Chairman & Chief Executive Officer, Bangkok Chain Hospital

Oran VongsuraphichetChief Executive Officer, Thai Reinsurance

Juk KosalyawatThai Healthtech Association

Rubkwan CholdumrongkulCo-Founder and Chief Legal Officer, Easy Company Group

|

HealthTech: the innovation

How is HealthTech going to play an important role in enhancing the insurance business opportunities?

Let's open up and talk about HealthTech trends that will create new opportunities for the insurance industry. Study new ideas from the successful entrepreneurs that can be applied to insurance businesses and learn about what HealthTech expects from the insurance industry. In particular, how insurance technology or InsurTech will help develop the integration of HealthTech and Insurance Business together to enhance the benefits of each other. Thus, deliver additional benefits for customers and the general public. |